Coaching is growing fast.

More coaches. More revenue. Growth in every niche.

But what do the numbers actually show?

I gathered 35+ coaching statistics from recent industry reports.

Market size, regional trends, ROI data, and what's next.

If you're building a coaching business or considering it, here's what you need to know.

Editor’s picks

- There were 122,974 active coaches worldwide in 2024, which is 15% higher than 2023.

- Global coaching revenue reached $5.34 billion in 2024, growing 17% year over year.

- The life coaching market is projected to hit $6.12 billion by 2031, up from $3.97 billion in 2026, at a 9.05% CAGR.

- The online coaching market is expected to reach $11.7 billion by 2032, growing at a 14% CAGR (2023-2032).

- The executive coaching and leadership development market is forecast to grow from $112.98 billion in 2026 to $174.53 billion by 2031, at a 9.11% CAGR.

- MetrixGlobal study reporting a 529% ROI on executive coaching.

- In India, the online coaching market was $437.64 million in 2024 and is projected to grow at a 16.55% CAGR through 2033.

The numbers tell a clear story: coaching has moved from optional to essential.

And it's growing fast.

You're seeing it across the board.

More coaches entering the market, higher total revenue, and major growth in niches like life coaching and online coaching.

Corporate coaching is on a different scale entirely, with executive coaching markets worth hundreds of billions.

If you're a coach (or you work with coaches), this is why demand is up and competition feels more intense at the same time.

Sources:

- 122,974 active coaches in 2024 (+15% YoY) – ICF (International Coaching Federation)

- $5.34B global coaching revenue in 2024 (+17% YoY) – ICF

- Life coaching market: $3.97B (2026) → $6.12B (2031), 9.05% CAGR – Mordor Intelligence

- Online coaching market: $11.7B by 2032, 14% CAGR (2023-2032) – Allied Market Research

- Executive coaching & leadership dev.: $112.98B (2026) → $174.53B (2031), 9.11% CAGR – Mordor Intelligence

- ROI on executive coaching – MetrixGlobal

- India online coaching: $437.64M (2024), 16.55% CAGR to 2033 – IMARC Group

Global market size

- There were 122,974 active coaches worldwide in 2024, which is 15% higher than 2023.

- The life coaching services market was $3.4 billion in 2024 and is projected to reach around $8.4 billion by 2034, at a 9.5% CAGR

- The global sports coaching market is expected to hit $12.71 billion by 2031, growing at a 9.73% CAGR from 2025. This shows strong demand beyond just business coaching.

- The U.S. life coach market is projected to grow from $2.07 billion in 2023 to $2.76 billion by 2029, at a 4.9% CAGR.

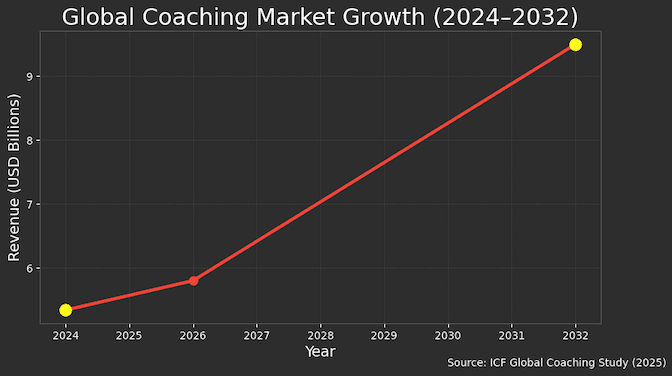

- In 2024, global coaching revenue hit $5.34 billion. It's projected to reach $5.8B in 2026 and scale to $9.5B by 2032, growing at an 8.53% CAGR.

Here's what stands out.

Coaching isn't just one market.

It's a collection of different categories like life coaching, sports coaching, and corporate coaching. And each one is growing at its own pace.

So when you see different "market size" numbers, it usually depends on how the report defines coaching.

But the trend is clear.

More money is flowing into coaching, and demand is spreading across both personal and professional use cases.

Sources:

- Global coaching revenue: $5.34B (2024) → $5.8B (2026) → $9.5B (2032) – ICF

- 122,974 active coaches in 2024 (+15% YoY) – ICF (International Coaching Federation)

- Life coaching services: $3.4B (2024) → ~$8.4B (2034), 9.5% CAGR – Market

- Sports coaching market: $12.71B (2031) – TechSci Research

- U.S. life coach market: $2.07B (2023) → $2.76B (2029), 4.9% CAGR – Research and Markets

Regional and sector growth

- Asia-Pacific life coaching is growing at a 10.2% CAGR, showing how fast coaching adoption is accelerating in this region.

- In India, the online coaching market was $437.64M in 2024 and is projected to reach $1,934.11M by 2033, growing at a 16.55% CAGR (to 2033).

- North America held a 40% share of the life coaching services market in 2024, which shows it is still the biggest demand center.

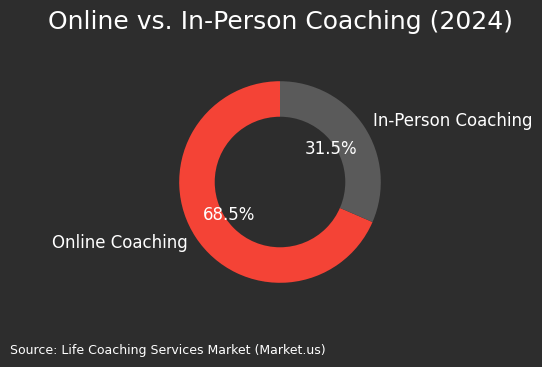

- Online delivery accounted for 68.5% market share in 2024, which tells you most coaching is now happening on calls, not in-person sessions.

- The global sports coaching market is expected to hit $12.71B by 2031, growing at a 9.73% CAGR from 2025.

- The business coaching market is projected to grow from $2.64B (2025) to $2.81B (2026), and reach $4.19B by 2032 at a 6.82% CAGR.

- A Manchester review study found that executive coaching delivered an average ROI of 5.7x the initial investment. That's a return of over $100,000.

Growth isn't happening at the same speed everywhere.

Some regions are moving fast.

And some sectors are growing faster because they work well online.

India shows this clearly. The jump from $437.64M to $1.93B is massive.

North America still leads in life coaching demand, but Asia-Pacific is closing the gap.

And with online delivery making up nearly 70% of the market, digital-first coaching is now the standard.

Sources:

- India online coaching: $437.64M (2024) → $1,934.11M (2033), 16.55% CAGR – IMARC Group – IMARC report

- North America life coaching share: 40% (2024) – Life coaching services market

- Online delivery share: 68.5% (2024) – Life coaching services market

- Sports coaching market: $12.71B (2031) – TechSci Research

- Business coaching market: $2.64B (2025) → $4.19B (2032), 6.82% CAGR – Research and Markets

- ROI on executive coaching – Perspect

Coach practitioner insights

- The average annual coaching revenue was $49,283 in 2024.

- 59% of coaches expect higher earnings in 2025 by working with more clients.

- 51% of coaches predict global coaching sessions will increase, which signals rising demand.

- 73% of coaches say clients want certifications, which means credibility still matters in buying decisions.

- 99% of coaches report having coach-specific training, which shows how professionalized the industry has become.

- One estimate puts the average number of active clients per coach at 12.4.

The coaching industry is maturing fast.

And getting more competitive at the same time.

Most coaches aren't just doing 1:1 sessions anymore.

They're bundling training, consulting, and structured programs to increase revenue per client.

At the same time, clients are getting pickier, with certification and formal training becoming a stronger trust signal.

Sources:

- Average annual coaching revenue: $49,283 (2024) – ICF

- Coaches expecting higher earnings: 59% (2025) – ICF

- Coaches predicting session increases: 51% – ICF

- Clients wanting certifications: 73% – ICF

- Coaches with coach-specific training: 99% – ICF

ROI and impact metrics

- MetrixGlobal study reporting a 529% ROI on executive coaching.

- ICF hosted 35,000+ event participants in 2024, showing just how big the coaching ecosystem has become.

- Coach Core trained 1,056 apprentices in 2024, and 74% graduated.

- Coach Core delivered 43,899 community sessions in 2024, which is a massive amount of real-world coaching time.

- ICF’s 2024 research links coaching to improved well-being, which makes coaching easier to justify beyond just “performance.”

- 77% of executives said coaching had a significant impact on at least one major business metric.

This is why coaching keeps getting funded, especially in leadership and executive roles.

But impact goes beyond ROI.

Training programs, graduation rates, and sessions delivered show real results at scale.

And the well-being connection makes coaching even more valuable.

It's not just about better KPIs anymore. It's about building healthier, stronger teams.

Sources:

- ROI on executive coaching – MetrixGlobal

- 1,056 apprentices trained; 74% graduated (2024) – Coach Core annual impact report

- 43,899 community sessions delivered (2024) – Coach Core

- Improved well-being via coaching (2024 survey) – ICF

- Coaching had a significant impact – MetrixGlobal

AI coaching

- Coaching platforms (including AI tools) are projected to hit around $6B by 2032, growing at a CAGR of 13.9%.

- The AI career coach market is expected to grow from $4.2B in 2024 to $23.5B by 2034, at an 18.7% CAGR.

- As of 2025, 47% of coaches use digital platforms, which makes it easier to plug AI into delivery workflows (one-on-one virtual coaching sessions – 35% and client management – 23%).

- The ICF has published guidance on AI coaching framework standards, with a focus on keeping humans accountable for outcomes, safety, and ethics.

- In the U.S., the AI career coaching market is estimated at $1.24B, with a projected 15.6% CAGR.

AI coaching isn't replacing human coaches. It's changing how coaching gets delivered.

AI turns coaching into something you can access on demand. And that matters because coaching usually breaks down between sessions.

People forget the plan. They lose momentum.

AI tools fill that gap with prompts, check-ins, and habit tracking.

💡 The real shift isn't "AI vs humans". It's hybrid delivery becoming the default. Humans do the high-trust, high-context work. AI handles the repeatable support in between.

Sources:

- ~$6B coaching platforms by 2032 (13.9% CAGR) – Verified Market Research

- $4.2B (2024) to $23.5B (2034) AI career coach market (18.7% CAGR) – AI Career Coach Market

- 47% coaches use digital platforms (2025) – ICF

- AI coaching framework standards guidance – ICF

- $1.24B U.S. AI career coaching market (15.6% CAGR) – Ukai

Future forecasts and trends

- Global coaching market is projected to reach $5.8B in 2026 and scale to $9.5B by 2032, growing at an 8.53% CAGR.

- The life coaching market is expected to grow from $3.97B (2026) to $6.12B by 2031, at a 9.05% CAGR.

- The executive coaching and leadership development market is forecast to rise from $112.98B (2026) to $174.53B by 2031, at a 9.11% CAGR.

- The online coaching market is projected to reach $11.7B by 2032, growing at a 14% CAGR (2023-2032).

- The business coaching market is projected to grow from $2.64B (2025) to $4.19B by 2032, at a 6.82% CAGR.

- The U.S. life coaching market is estimated at $1.98B (2024) and is expected to reach $3.08B by 2033, at a 5.05% CAGR (2025-2033).

- Coaching platforms in the U.S. are projected to grow at a 9.2% CAGR through 2035.

- 59% of coaches expect higher earnings in 2025, mainly by taking on more sessions and clients.

These forecasts show something clear.

Demand isn't just growing. It's spreading across every type of coaching.

From solo life coaches to corporate leadership programs. And from 1:1 sessions to platforms that turn coaching into software.

If you're in coaching, the next few years will reward people who package their expertise, build proof, and make it easier to buy.

Sources:

- Global coaching market: $5.8B (2026) → $9.5B (2032), 8.53% CAGR – ICF

- Life coaching market: $3.97B (2026) → $6.12B (2031), 9.05% CAGR – Mordor Intelligence

- Executive coaching & leadership dev.: $112.98B (2026) → $174.53B (2031), 9.11% CAGR – Mordor Intelligence

- Online coaching market: $11.7B by 2032, 14% CAGR (2023-2032) – Allied Market Research

- Business coaching market: $2.64B (2025) → $4.19B (2032), 6.82% CAGR – Research and Markets

- U.S. life coaching market: $1.98B (2024) → $3.08B (2033), 5.05% CAGR (2025-2033) – Grand View Research

- Coaching platforms in the U.S.: 9.2% CAGR through 2035 – Future Market Insights

- Coaches expecting higher earnings in 2025: 59% – ICF

Verdict

Coaching isn't optional anymore. It drives revenue, keeps people around, and protects well-being all at once.

The numbers back it up.

Demand is growing across every type of coaching, from life coaches to AI-powered platforms.

If you're building or scaling a coaching business, now's the time to get clear on your positioning, track what's working, and make it easy for people to buy.

What's your next step?